Scroll down to access FREE calculators and downloadable spreadsheet tools for investors.

These tools are discussed in Chapter 4 of Rich Warner’s book The Smart Investor’s Guide to Bucket Investing.

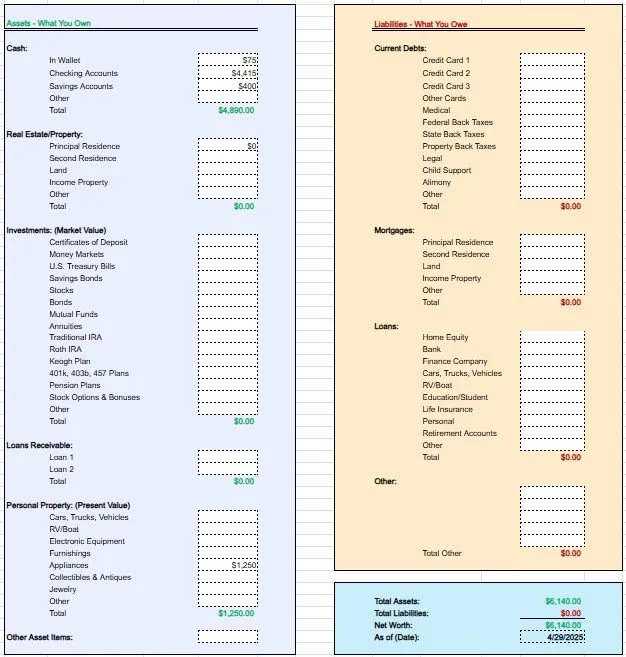

Net Worth Calculator

A custom-designed Excel spreadsheet that helps you calculate household net worth.

Monthly Cash Flow Tracker

This spreadsheet calculates monthly and annual household net income, using income and expense cash flow data.

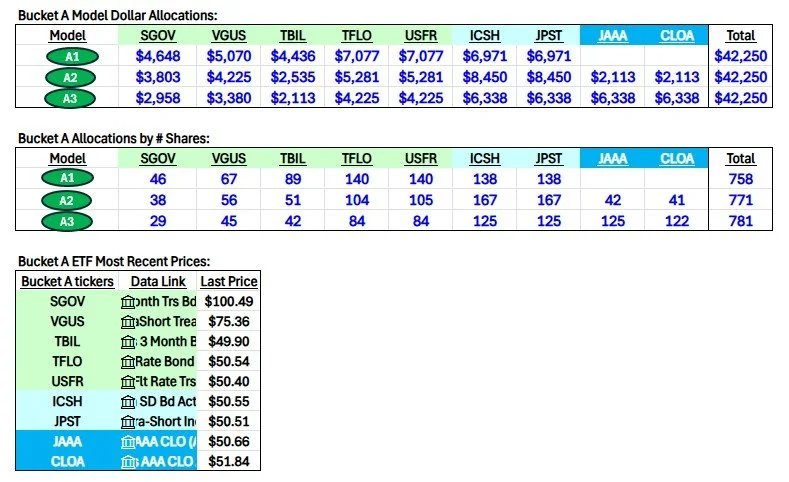

Rebalance Spreadsheet

Use this spreadsheet to determine dollar size and share size allocations for all the ETF models discussed in Rich Warner’s book on bucket investing. You must buy the eBook on Amazon before you can access the models. Click on the button below to buy your copy now.

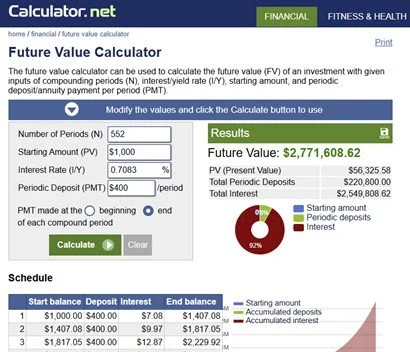

Future Value (FV) Calculator

How much will my portfolio be worth by the time I retire, if I contribute $X per month and get 7.5% annual returns? This free online FV calculator can help project portfolio values into the future.

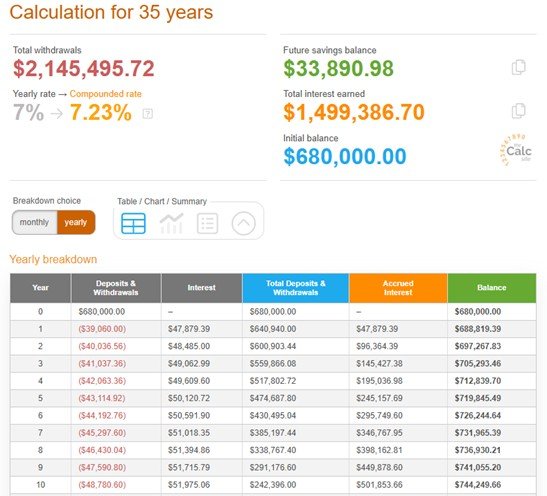

Portfolio Longevity Calculator

How long will your money last?

This FREE online calculator will help determine whether you will outlive your financial assets.

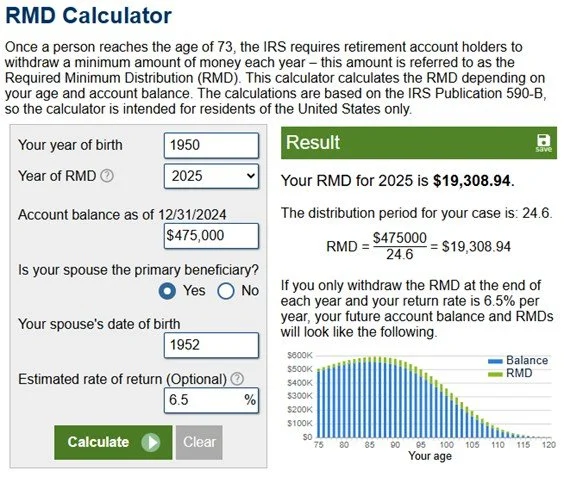

RMD Calculator

How much do I need to withdraw from my traditional IRA or 401K to comply with IRS tax rules?

Use this FREE online calculator to help answer that question.